-

太阳成集团tyc33455cc2023年秋季学期2023级学生转...

- 太阳成集团tyc33455cc2023年秋季学期2022级学生转... 2023-12-13

- 太阳成集团tyc33455cc2023年秋季学期转专业面试成... 2023-12-13

- 太阳成集团tyc33455cc2023年秋季学期转专业笔试成... 2023-12-10

- 太阳成集团tyc33455cc2023年秋季学期转专业面试安... 2023-12-10

- 太阳成集团tyc33455cc2023年秋季学期本科生转专业... 2023-12-08

- 2023-2024学年太阳成集团tyc33455cc转专业考试大纲 2023-11-28

学部动态

|

太阳成获批“中华医学会医学教育... | 2023-12-29 |

|

“净山运动,无痕山野”活动圆... | 2023-12-19 |

|

太阳成集团tyc33455cc举办“口腔... | 2023-12-06 |

|

太阳成集团tyc33455cc教职工第一届运动会成功举办 | 2023-11-24 |

|

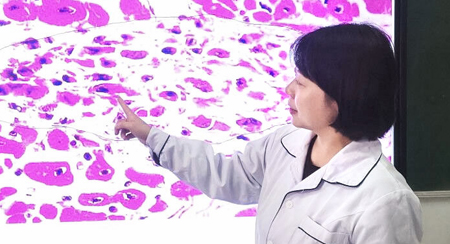

医学基础实验绘图大赛圆满结束 | 2023-11-23 |

|

太阳成集团tyc33455cc2023年“一二·九”诗歌朗... | 2023-11-23 |

|

太阳成集团tyc33455cc第六届迎新杯辩论赛决赛... | 2023-11-17 |